december child tax credit amount 2021

The refundable portion of the credit was also limited to 1400 per child. Click to see a chart to compare the new changes to the CTC.

4 Commonly Overlooked Tax Deductions Not To Miss Tax Deductions Tax Refund Tax Time

If you did not receive the stimulus for a dependent you can claim it on your 2021 tax return as the Recovery Rebate Credit.

. To be eligible for the maximum credit taxpayers had to have an AGI of. This amount was then divided into monthly advance payments. 150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower.

For the 2021 tax credit the phaseout begins at a modified AGI of 75000 for single filers 150000. The Democrat Senators are trying to. 150000 for a person who is married and filing a joint return.

The CTC amount will start to gradually decrease starting at 75000 150000 for married couples and 112500 for head of household. Before this tax year the child tax credit was capped at 2000 per qualifying child and 17-year-olds didnt qualify. 3600 for children ages 5 and under at the end of 2021.

The American Rescue Plan Act of 2021 raised the amount of the child tax credit to 3000 per child or 3600 per child under age 6. During the period July through December 2021 eligible families with children under the age of 18 received Advanced Child Tax Credit payments. However families that are already receiving the maximum payment on the child tax credit scheme will not receive an increased payment.

Up to 3600 for each qualifying child under age 6. You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. Check on Advanced Child Tax Credit Payments.

For each qualifying child age 5 or younger an eligible individual generally received 300 each month. Lowers the phase out rate. Your newborn child is eligible for the the third stimulus of 1400.

Under the enhanced CTC. That was determined by dividing. It also made the parents or guardians of 17-year-old children newly eligible for up to the full 3000.

Children still must be US. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. The maximum CTC payment currently stands at 300 dollars per.

3000 for children ages 6 through 17 at the end of 2021. The credit increased from 2000 per. For 2021 eligible families claiming the child tax credit will receive.

For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5. 75000 for a single filer or a person who is married and filing a separate. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17.

President Biden has proposed extending the enhanced Child Tax Credit including monthly payments for at least 2022. Thats because the expanded CTC divided the benefit between monthly checks issued starting in July and ending in December with the other half to be claimed on tax returns. Democrats beefed up the child tax credit to a maximum of 3600 for each child up to age 6 and 3000 for each one ages 6 through 17 as part of the American Rescue Plan Act enacted in March 2021.

Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. The Child Tax Credit is a fully refundable tax credit for families with qualifying children. Citizens or resident aliens claimed as a dependent and living with the claiming taxpayer for at least six months during the year.

The Child Tax Credit under the American Rescue Plan rose from 2000 to 3000 for every qualified child over the age of six and from 2000 to 3600 for each qualifying child under the age of six beginning in tax year 2021 the taxes you file in 2022. In TurboTax Online to claim the Recovery Rebate credit please do the following. An eligible individuals total advance Child Tax Credit payment amounts equaled half of the amount of the individuals estimated 2021 Child Tax Credit.

112500 for a family with a single parent also called Head of Household. The IRS will send you monthly payments for half your new credit between July and December 2021. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

2021 Child Tax Credit and Advance Payments. Your newborn should be eligible for the Child Tax credit of 3600. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child.

The 500 nonrefundable Credit for Other Dependents amount has not changed. Therefore any families expecting to receive the payment of 250 to 300 per child on December 15 could see this be their last monthly Child Tax Credit payment. The Child Tax Credit Update Portal is no longer available but you can see your advance payments total in your online account.

This is up from the 2020 child tax credit amount of 2000. How Much is the Child Tax Credit for 2021 2022. The American Rescue Plan expanded the Child Tax Credit for 2021 to get more help to more families.

If your modified adjusted gross income is too high the child tax credit begins to phase out. It also provided monthly payments from July of 2021 to December of 2021. Child tax credit enhancement Most parents have automatically received up to 300 for each child up to age 6 and 250 for each one ages 6 through 17 on a monthly basis which accounts for half of.

Those families who received these monthly payments will need to reconcile the Advanced Child Tax Credit payments they received during the period. From July to December of 2021 eligible families received up to 300 per child under six years old and 250 for children between the ages of six to 17.

Pin On Foster Adoptive Info Blogs

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Pieter Janssens Elinga Interior With Painter Woman Reading And Maid Sweeping 1668 Dutch Painters Baroque Painting Art History

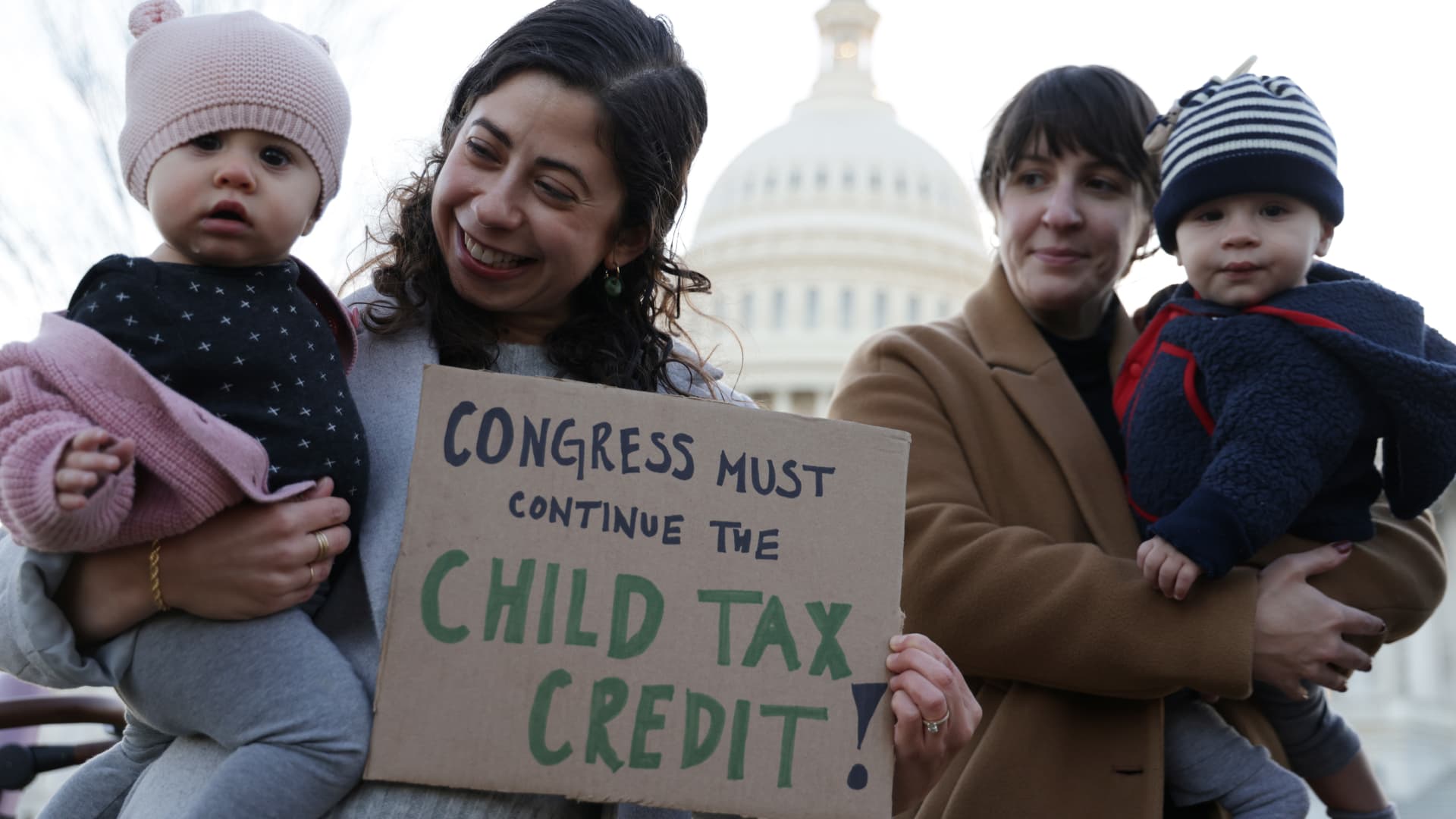

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Katsudeku Bakudeku Family My Hero Academia Manga Hero Academia Characters My Hero Academia Memes

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Your Guide To Tax Deductions In Germany For 2021 N26

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

The 2021 Child Tax Credit For Expats Are You Eligible Greenback Expat Tax Services

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Child Tax Credit For U S Citizens Living Abroad H R Block

Why Some Families May Have To Repay 2021 Child Tax Credit Payments